We can't find the internet

Attempting to reconnect

Something went wrong!

Attempting to reconnect

Dan Rasmussen - Private Equity Returns in Public Markets - [Invest Like the Best, EP.78]

Access AI content by logging in

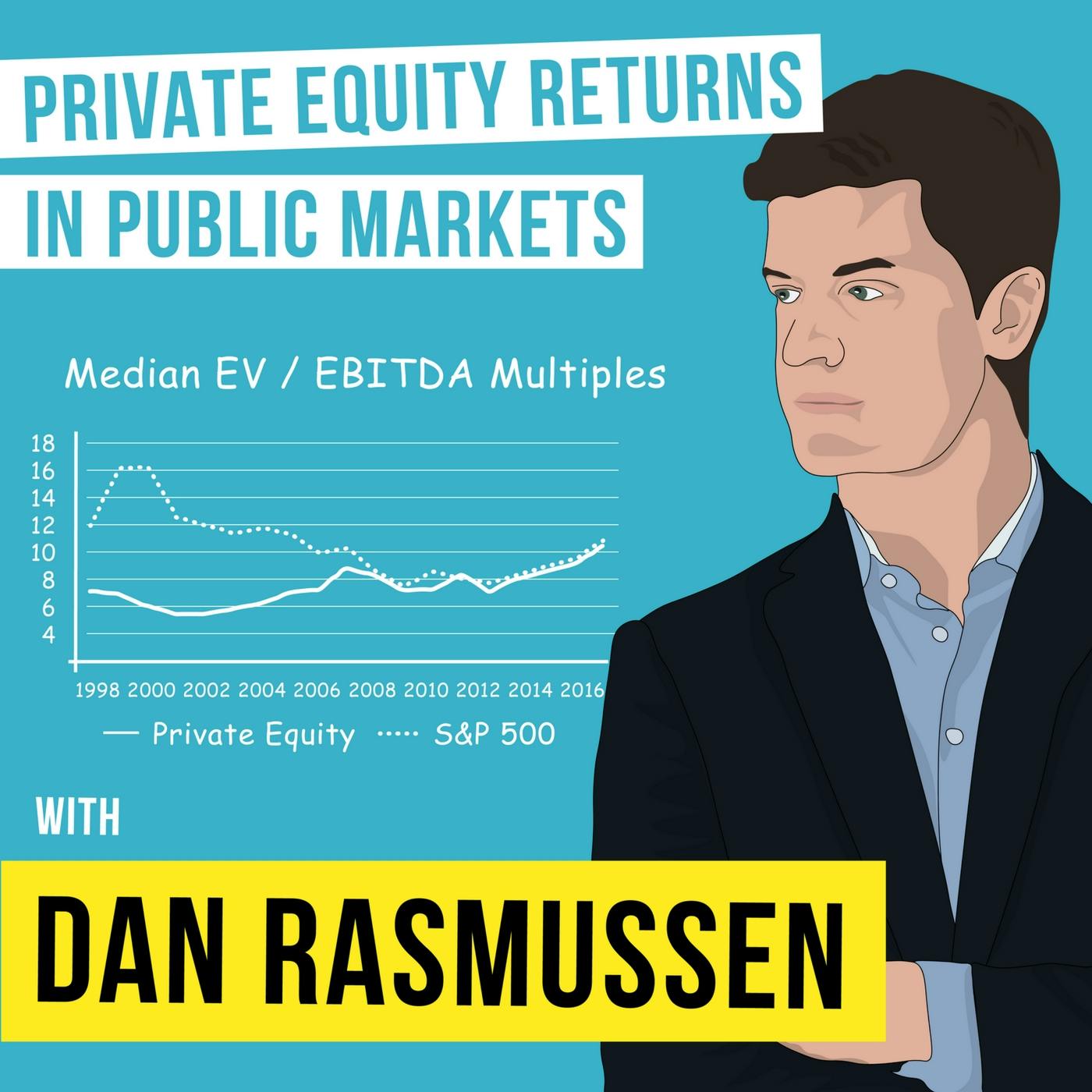

It has been a while since we discussed private equity on the show, so I was excited for this week’s conversation. My guest is Dan Rasmussen, the founder of Verdad advisers. Dan worked in private equity and has spent years studying the entire field.

Dan identified several key drivers of private equity’s outsized returns: size, value, and leverage. His firm uses these factors as a starting point to build a portfolio of public equities that behave like their private brethren.

We cover a ton of ground, discussing the prospective returns for equities, forecasting, and tons of investing strategies.

Please enjoy this conversation with Dan Rasmussen.

For more episodes go to InvestorFieldGuide.com/podcast.

Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub.

Follow Patrick on Twitter at @patrick_oshag

Links Referenced

Subscribe to Dan

The Gospel According to Michael Porter

Tobias Carlisle

Steven Pinker

E.O. Wilson

Books Referenced

What Works on Wall Street, Fourth Edition: The Classic Guide to the Best-Performing Investment Strategies of All Time

Quantitative Value, + Web Site: A Practitioner's Guide to Automating Intelligent Investment and Eliminating Behavioral Errors

Expert Political Judgment: How Good Is It? How Can We Know?

Superforecasting: The Art and Science of Prediction

Show Notes

2:03 – (First Question) – The current state of private equity investing

4:09 – The three myths of private equity

6:51 – Taking a deeper dive into the myth of growth through operational improvements

9:29 – What Works on Wall Street, Fourth Edition: The Classic Guide to the Best-Performing Investment Strategies of All Time

11:25 – Valuations for private market investment and where they’re going

14:03 – Private equity companies that have a higher chance of delivering results that exceed expectation

16:39 – Other observations on the private equity space that would be interesting to investors considering the asset class

19:33 – Importance of being very purposeful in picking your reference classes

19:42 – Subscribe to Dan

22:03 – How do the lessons Dan has learned in private equity translate to his investment strategies

25:21 – How do you apply purely technical, systematic thinking into public market investing

29:23 – Analyzing leveraged stocks and the value they could create

30:06 – How Dan thinks about the direction of debt vs just the level

33:11 – Predicting a firms ability to deleverage

35:20 – How Dan’s company whittle down a company and are able to see value beyond their quantitative screens

41:29 – How does Dan think about the global vs US opportunity set

44:22 – What originally drew Dan to the Japan market

47:03 – How do rising rates impact Dan’s strategy in investing in highly leveraged companies

55:03 – Porter’s five forces

55:25 - The Gospel According to Michael Porter

1:00:51 – How Dan thinks about competitive advantage

1:04:41 – Exploring Dan’s personal process in pursuit of his ideal strategy

1:05:19 – Quantitative Value, + Web Site: A Practitioner's Guide to Automating Intelligent Investment and Eliminating Behavioral Errors

1:05:20 – Tobias Carlisle

1:06:27 – Steven Pinker

1:06:28 – E.O. Wilson

1:07:11 – What other markets pique Dan’s interest

1:09:39 – Why there is such a focus on small for Dan

1:11:24 – Expert Political Judgment: How Good Is It? How Can We Know?

1:11:28– Superforecasting: The Art and Science of Prediction

1:12:54– What was it like writing the book

1:17:19 – If Dan was going to write another book today, what would it be about

1:19:08– Kindest thing anyone has done for Dan

Learn More

For more episodes go to InvestorFieldGuide.com/podcast.

Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub

Follow Patrick on twitter at @patrick_oshag