We can't find the internet

Attempting to reconnect

Something went wrong!

Attempting to reconnect

Hamilton Helmer – Power + Business - [Invest Like the Best, EP.174]

Access AI content by logging in

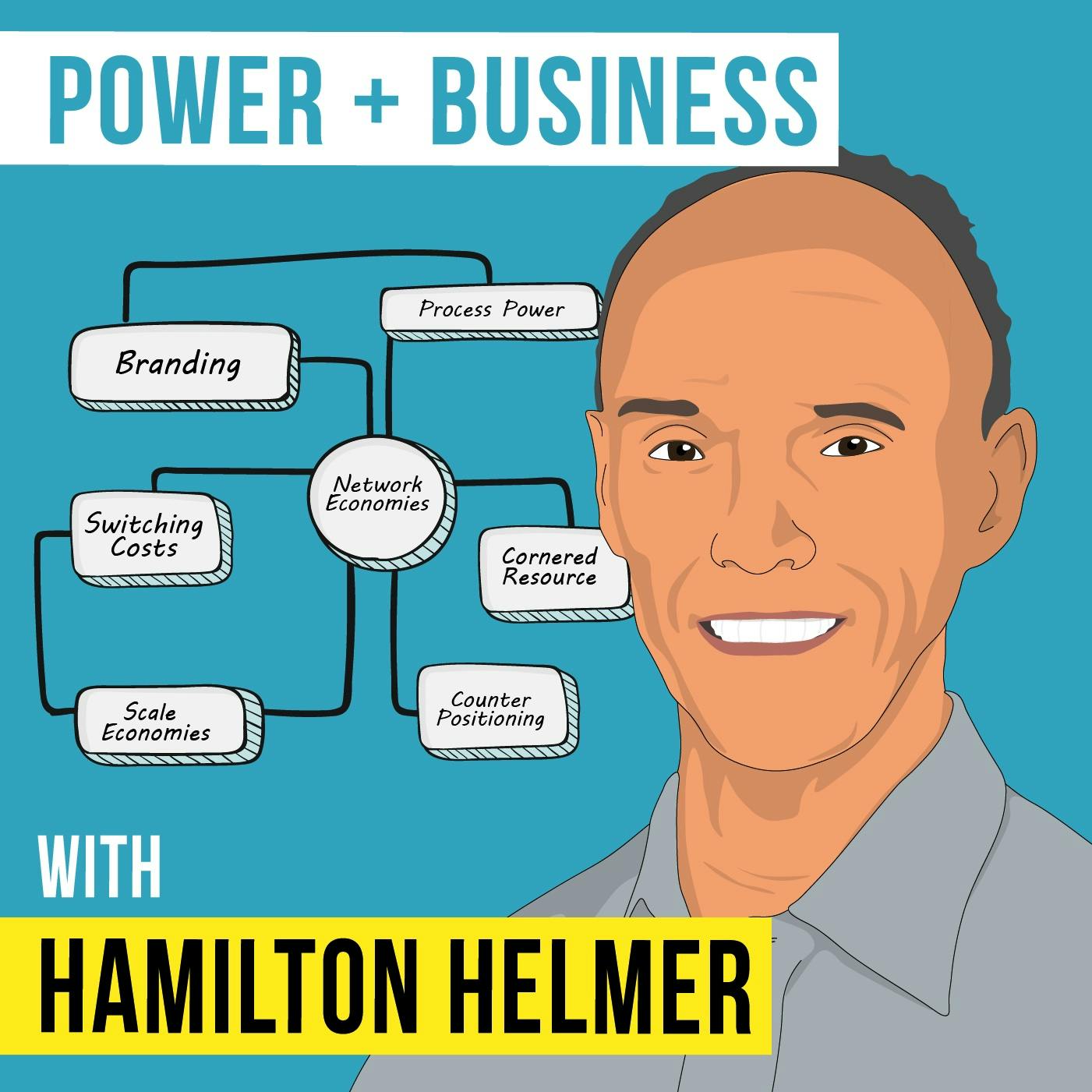

My guest today is Hamilton Helmer, the Co-Founder and Chief Investment Officer of Strategy Capital and the author of one of the best business books in history called 7 Powers, which is the topic of much of our conversation. He has spent his career as a practicing business strategist: advising companies, investing based on strategic insights and teaching strategy. In the last three decades, he has also utilized his strategy concepts as a public equity investor. In this conversation we cover all seven business powers, from counter-positioning to scale economies, and how companies earn and keep those powers. Any investor or businessperson should understand these concepts, and 7 Powers is the best work I’ve seen that explains them in depth. Please enjoy our conversation.

For more episodes go to InvestorFieldGuide.com/podcast.

Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub.

Follow Patrick on Twitter at @patrick_oshag

Show Notes

(1:31) – (First question) - What power means to him

(5:05) – Benefits being more common than barriers in the power equation

(6:28) – How early-stage companies develop their barriers

(11:23) – The power of counter positioning and how he’s seen it applied

(14:47) – The product side of counter positioning

(16:39) – Daniel Ek Podcast episode

(17:27) – Applying the idea of counter positioning to yourself

(20:40) – A cornered resource

(23:49) – A look at google as a cornered resource

(27:12) – Unique power of network economies

(31:18) – What subtleties disqualify network effects

(32:54) – Nuances of scale economies

(35:56) – Learning economies and who can scale it better

(37:07) – Building a switching cost and barrier into your business

(40:10) – Branding as power

(44:27) – Defining process power and how it differs from scale economies

(46:40) – The notion of the time lag and cash flow

(50:42) – Why is so much power concentrated in technology businesses

(52:07) – What does power mean for customers

(53:43) – Developing power as an art vs science, and the best power artists

(55:08) – The kindest thing anyone has done for him

Learn More

For more episodes go to InvestorFieldGuide.com/podcast.

Sign up for the book club, where you’ll get a full investor curriculum and then 3-4 suggestions every month at InvestorFieldGuide.com/bookclub

Follow Patrick on Twitter at @patrick_oshag